Spanish PV market uncovered to over-investment possibility by 2030

Fresh recordsdata from Afry Management Consulting means that Spain’s characterize voltaic vitality producers might face costs below €20/MWh earlier than 2030 if renewable penetration continues to expand. Such low costs would render vitality aquire agreements (PPAs) and carrier provider initiatives unprofitable.

Pilar Sánchez Molina

From pv journal Spain

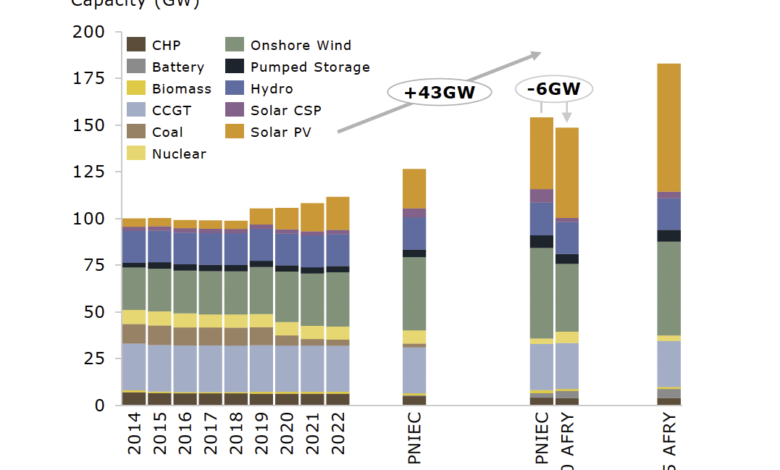

At an tournament organized by Afry Management Consulting, the penalties of closing nuclear vitality plant life in Spain were analyzed, and the doable deployment of characterize voltaic and wind vitality to catch up on the inability of skill was once talked about.

For the time being, there are 60 GW of licensed necessary-scale renewable initiatives, whereas the Spanish characterize voltaic affiliation UNEF has requested an upward revision of the nation’s vitality technique to enable the deployment of an additional 65 GW of PV skill by 2030.

If basically the most popular deployment price continues, it is a long way projected that there’ll seemingly be 75 GW of attach in skill in 2030, surpassing the forecasts of basically the most popular vitality technique. Photograph voltaic vitality is anticipated to exceed 50 GW, whereas wind vitality might not attain 40 GW because of the approval task boundaries.

In outrageous eventualities modeled by Afry, the distinction in characterize voltaic earnings between a explain of moderate renewables and high battery penetration and a explain of high renewable penetration shall be practically €40/MWh, with the latter dropping below €20/MWh from 2025.

The consultancy firm highlights that there are quite a whole lot of launched initiatives whose realization is unsure and that the high renewable penetration explain has less attach in PV skill in 2030 than the unusual targets proposed for the vitality technique.

Smartly-liked say material

Relating to storage, Afry means that up to 17 GW, along side pumped hydro, shall be worthwhile nonetheless would require incentives for installation. The consultancy foresees 3-4 GW of grid-connected electrolyzers by 2030 in a popular explain.

As characterize voltaic costs decline, earnings for producers decreases, making vitality aquire agreements (PPAs) unfeasible if retail costs fall below the levelized price of vitality (LCOE). Handiest the manager shall be willing to pay above-market costs in this form of explain.

The early closure of nuclear plant life would expand reliance on gas mixed cycle plant life, main to bigger costs and more volatility. It raises the demand whether to prioritize bigger renewable generation with bigger emissions or delay nuclear shutdown to decrease emissions and unhurried down renewable deployment.

A take into story on the security of supply in the tournament of nuclear shutdown has additionally been deemed principal.

This say material is safe by copyright and must no longer be reused. If you happen to favor to cooperate with us and would decide to reuse some of our say material, please contact: editors@pv-journal.com.