The Present: Stock market ‘exceptionally’ presumably to now not climb this 300 and sixty five days to epic height, says Stifel’s Barry Bannister

The soaring S&P 500 index will presumably fail to realize a epic height by the conclude of the 300 and sixty five days, in conserving with Stifel’s chief equity strategist Barry Bannister.

“A new high by 300 and sixty five days-conclude 2023 is exceptionally presumably now not,” Bannister said in a display Tuesday. While equity strategists that he considers “uber-bulls” anticipate the index would possibly per chance perhaps hit a epic designate of around 4,800 by then, Bannister said that level is “quiet out of attain.”

The U.S. inventory market has jumped this 300 and sixty five days in a so far resilient economy, even because the Federal Reserve continued lifting passion rates, albeit at a slower tempo, to fight quiet elevated inflation. However the S&P 500 would require “very favorable” earnings per piece and monetary conditions, which would possibly per chance perhaps very smartly be presumably now not, to climb aid to its prior all-time high, in conserving with Bannister.

The S&P 500 has already soared 17.1% this 300 and sixty five days by Tuesday, leaving it proper 6.2% off its epic conclude of 4,796.56 in early January 2022, in conserving with Dow Jones Market Data.

Indispensable U.S. inventory benchmarks closed decrease Tuesday, as merchants resumed buying and selling after coming back from the three-day weekend celebrating Labor Day. The S&P 500

SPX

fell 0.4% to whole at 4,496.83, whereas the Dow Jones Industrial Average

DJIA

dropped 0.6% and the expertise-heavy Nasdaq Composite

COMP

shed 0.1%, FactSet records display.

Bannister is expecting the S&P 500 to whole the 300 and sixty five days at 4,400. That compares with a median 300 and sixty five days-conclude target of 4,350, he said, citing a Bloomberg search for of U.S. sell-aspect equity strategists.

To attain 4,800, the S&P 500 wants a monetary conditions index “conclude to generational lows,” he said. “We doubt the Fed desires that.”

The Fed has been tightening monetary coverage since early 2022, in a insist to carry down inflation that remains above its 2% target.

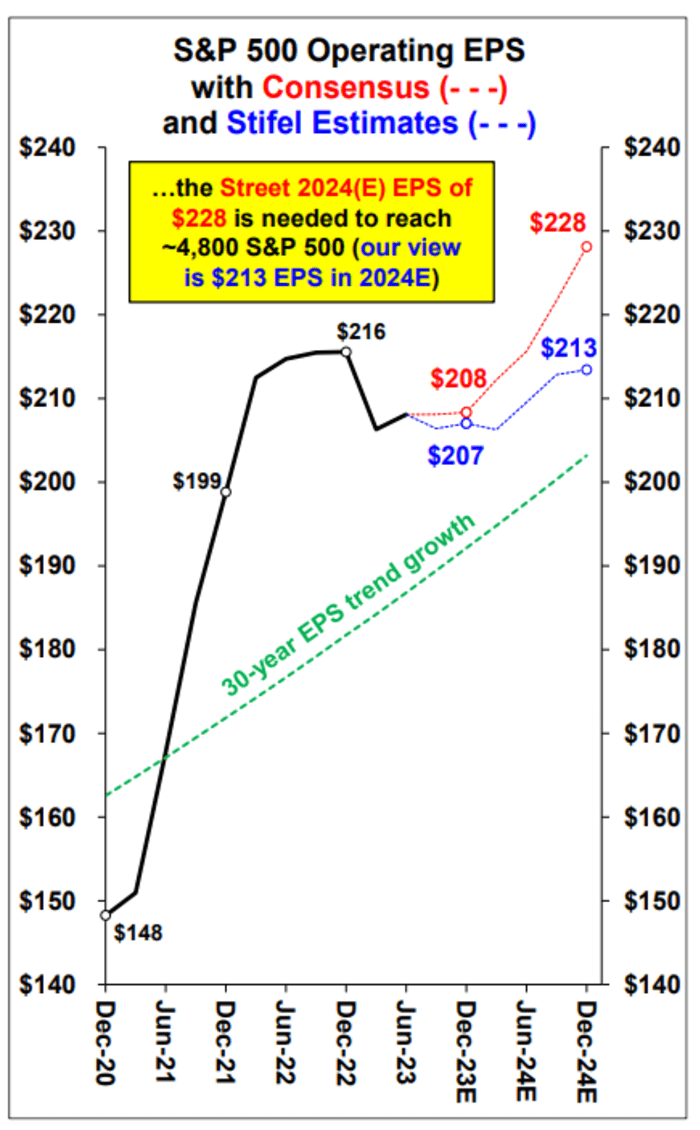

“The replacement self-discipline is EPS, and the Road appears high to us,” Bannister said of Wall Road’s expectations for the S&P 500’s earnings per piece.

STIFEL NOTE DATED SEPT. 5 2023

The “slowdown” in cyclical financial records in 2023, seen with a plod after the Fed’s rate hikes, “will comprise to restrain 2024 EPS bellow for expertise,” in conserving with Bannister. “Hyperpositive slack-2023 views are presumably to now not advance aid to pass, no matter whether or now not ‘Contemporary Period’ AI bot thinking disagrees with us,” he wrote.

This 300 and sixty five days’s man made-intelligence craze has helped gasoline the S&P 500’s rally, whereas some merchants anticipate a doable at ease touchdown for the economy after the Fed slowed its rate hikes in 2023 towards the backdrop of easing inflation.

In the meantime, the S&P 500’s equity probability top class is now 3%, a level Bannister described as neither low nor high “nonetheless presumably a cost of a return to normality in an completely priced market.”

“The first half of S&P 500 aid rally is over,” said Bannister. The “2nd half of will proper be flat.”