Sensex This day | Inventory Market LIVE Updates: GIFT Nifty alerts a opposed beginning up; Asian shares alternate lower

16 Jan, 2024 | 08:51:35 PM IST

Nifty on Tuesday ended 65 ingredients lower to face resistance across the psychological stage of twenty-two,000. The hourly momentum indicator has resulted in a opposed crossover indicating loss of momentum on the upside.

OI recordsdata showed that on the name aspect, the most sensible OI used to be observed at 22,100 followed by 22,200 strike prices while on the put aspect, the most sensible OI used to be at 22,000 strike designate. On the quite a lot of hand, Financial institution nifty has fortify at 47,800-47,650 while resistance is positioned at forty eight,500 and forty eight,650 ranges.

Tell more Tell less

HDFC Financial institution ADRs plunge over 2% put up Q3 outcomes, is the scorecard base?

The American Depository Receipts (ADRs) of HDFC Financial institution dropped bigger than 2% in alternate on the Recent York Inventory Change after the lender launched its numbers for the quarter ended December. The ADRs had been 2.6% down at $63.89 on the NYSE.

American funding agency sells 1.5% stake in Indigo Paints for Rs 104 crore

American funding agency Smallcap World Fund has sold a partial stake in Indigo Paints by the commence market on Tuesday for Rs 104 crore.

US stocks commence lower as Tesla, Apple weigh; broad banks in center of attention

Wall Avenue’s main indexes opened lower on Tuesday, as Tesla and Apple weighed, while investors gauged mixed earnings reports from Goldman Sachs and Morgan Stanley for insights into the health of capital markets and dealmaking.

The Dow Jones Industrial Average fell ninety nine.44 ingredients, or 0.26% on the commence to 37,493.54.

The S&P 500 opened lower by 11.forty eight ingredients, or 0.24%, at 4,772.35, while the Nasdaq Composite dropped 64.50 ingredients, or 0.43%, to 14,908.26 on the outlet bell.

ICICI Securities Q3 Outcomes: Profit jumps 66% to Rs 466 crore

Brokerage dwelling ICICI Securities on Tuesday reported a 66% 365 days-on-365 days jump in profit after tax (PAT) to Rs 465.7 crore in three months ended December 2023. In comparability, the company had posted a PAT of Rs 280.9 crore in the October-December quarter of the previous fiscal (FY23), ICICI Securities, a element of ICICI Neighborhood, talked about in a regulatory filing.

Capital Dinky Finance Financial institution, Krystal Constructed-in Providers bag Sebi’s nod to breeze IPOs

Three entities — Capital Dinky Finance Financial institution, Krystal Constructed-in Providers and Vibhor Steel Tubes — possess received Sebi’s bound-forward to take funds by preliminary public offerings (IPOs). All three firms, which filed their preliminary IPO papers with the capital markets regulator in October 2023, received their observation letters at some level of January 8-12, an update with the Sebi showed on Tuesday.

Tech Word: Nifty faces resistance around Mt 22K. What merchants must quiet stop on Wednesday

Nifty on Tuesday ended 65 ingredients lower to face resistance across the psychological stage of twenty-two,000. The hourly momentum indicator has resulted in a opposed crossover indicating loss of momentum on the upside.

OI recordsdata showed that on the name aspect, the most sensible OI used to be observed at 22100 followed by 22200 strike prices while on the put aspect, the most sensible OI used to be at 22000 strike designate. On the quite a lot of hand, Financial institution nifty has fortify at 47800-47650 while resistance is positioned at 48500 and 48650 ranges.

FPIs remain uncover customers for 2d straight day

Foreign portfolio investors continue to be uncover customers at Rs 656 crore on Tuesday. DIIs sold shares rate Rs 369 crore.

IBS Instrument acquires Above Property Providers in Rs 747-cr deal

In a indispensable pass to further fortify its presence in the worldwide shuttle alternate, Thiruvananthapuram Technopark-basically based IBS Instrument on Tuesday presented its acquisition of Above Property Providers (APS®), a pioneering hotel and shuttle abilities provider. The deal, valued at $90 million (Rs 747 crore), marks a strategic step for IBS Instrument in solidifying its space in the hospitality market and amplifying its tag energy.

Shell suspends all Crimson Sea shipments

British oil indispensable Shell suspended all shipments by the Crimson Sea indefinitely after US and U.Good enough. strikes on Yemen’s Houthi rebels resulted in fears of further escalation, the Wall Avenue Journal reported on Tuesday, citing of us mindful of the decision. Attacks on ships by the Houthis, who enlighten they are performing in cohesion with Palestinians, possess disrupted worldwide commerce.

Morgan Stanley Q4 Outcomes: Profit falls on one-time prices

Morgan Stanley’s profit dropped in the fourth quarter, damage by one-time prices tied to a Federal Deposit Insurance Corporation’s (FDIC) special analysis and an precise topic. The monetary institution, alongside rival broad-cap banks, also could be on the hook to pay a completely different analysis prices to the FDIC to hang up a fund that used to be drained by practically $16 billion in March 2023 after three mid-sized U.S. lenders collapsed.

Goldman Sachs Q4 Outcomes: Profit climbs 51% as fairness merchants run market rebound

Goldman Sachs’ profit rose 51% in the fourth quarter as its fairness merchants capitalized on a recovery in markets, it talked about on Tuesday.

The monetary institution reported a profit of $2.01 billion, or $5.forty eight per portion, for the latest quarter, compared with $1.33 billion, or $3.32 per portion, a 365 days earlier.

“This used to be a 365 days of execution for Goldman Sachs,” CEO David Solomon talked about in an announcement. “With every little thing we executed in 2023 coupled with our sure and simplified strategy, we possess a noteworthy stronger platform for 2024.”

Sri Lanka shares dwell lower for sixth straight day as user staples, industrials weigh

Sri Lankan shares closed lower on Tuesday for the sixth straight session, dragged by losses in user staples and industrial stocks.

* The CSE All Portion index settled down 0.6% at 10,545.88.

* Melstacorp PLC and Expolanka Holdings PLC had been the high losers on the CSE All Portion, falling 3.9% and 0.9%, respectively.

Nifty Financial institution kinds ‘Doji’ candle on Tuesday; immediate fortify viewed at 47800

The Nifty Financial institution closed flat nonetheless with a opposed bias on Tuesday after rallying for four consecutive lessons as investors most in model to hold some earnings amid muted worldwide cues.

The Nifty Financial institution fell 33 ingredients to conclude at forty eight,125 while the Nifty50 managed to closed above 22000, down 65 ingredients from yesterday’s conclude.

The Financial institution Nifty index displayed a doji candle, signaling a battle between bulls and bears in the sizzling market anxiety. To seem for a continuation of the rally in direction of 49000/50000, the index must retain above the wanted stage of 48300. Conversely, the immediate lower-dwell fortify lies in the 47800-47700 zone, and a conclusive spoil beneath this stage could seemingly well well pave the manner for further design back movements

– Kunal Shah, Senior Technical & Spinoff Analyst at LKP Securities

Shriram Finance to worry over 3-yr buck denominated bonds

India’s Shriram Finance plans to take funds by US buck denominated bonds maturing in three years and three months, two carrier provider bankers talked about on Tuesday.

The funds will seemingly be feeble to fortify social initiatives and completely different activities allowed beneath the Reserve Financial institution of India’s external business borrowing pointers, a term sheet showed.

Rupee falls 21 paise to conclude at 83.07 (provisional) against US buck.

The broad market exhibited profit booking following a upright performance by the IT sector amid outdated worldwide cues. Traders are contemplating whether the sizzling euphoria in markets has gone farfetched, significantly with elevated domestic valuations in mid & cramped caps. FII flows are mixed as a result of an absence of fresh triggers. Oil prices stayed agency amid undeterred geopolitical tensions. The latest IIP enhance alerts conclude to-term softness.

– Vinod Nair, Head of Research, Geojit Financial Providers

Top gainers & losers in closing alternate

Price as on 03:34:56 PM 03:34 PM, Click on company names for their are dwelling prices.

Closing Bell: Sensex snaps 5-day winning hurry, slides 199 pts; Nifty holds 22K; Angel One plunges 14%, Voda Concept 5%

Sensex This day | Inventory Market Dwell Updates: ITC director David Robert Simpson resigns

Price as on 03:24:forty five PM 03:24 PM, Click on company names for their are dwelling prices.

GQG provides practically about 15 crore shares of ITC in Q3 vs outdated quarter

— ETNOWlive (@ETNOWlive)

Inventory Market Dwell Updates: Buck hits one-month high as rate-lower bets fall

The buck rose on Tuesday as investors tempered their expectations for a March rate lower from the Federal Reserve, while the pound and yen fell as inflationary pressures subsided.

Against a basket of currencies, the buck rose 0.47%to 103.13, a one-month high. It received 0.2% in a single day in subdued shopping and selling at some level of a US public vacation on Monday.

SBI to take up to Rs 50 billion through perpetual bonds

Insist Financial institution of India plans to take up to Rs 50 billion ($602.56 million), collectively with a greenshoe of Rs 30 billion, by Basel III-compliant additional tier-I bonds, three bankers talked about on Tuesday. The country’s largest lender has invited bids for this perpetual bond worry on Thursday. The bonds possess a name likelihood on the dwell of the tenth 365 days.

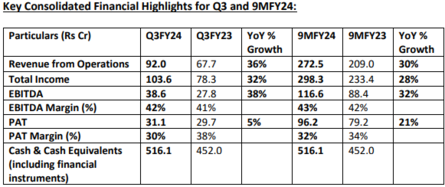

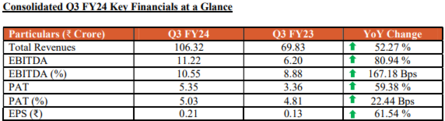

C.E. Files Programs (MapMyIndia) Q3 Outcomes

- Q3FY24 Total Profits used to be Rs 103.6 Cr

- Revenue grew 36% YoY to Rs 92 Cr, an all-time high, with 9MFY24 Revenue now at Rs 272.5 Cr

- Q3FY24 EBITDA grew 38% YoY and in 9MFY24 grew 32% YoY to Rs 116.6 Cr; 9MFY24 EBITDA margin at 43%

- 9MFY24 PAT grew 21% YoY to Rs 96.2 Cr, with PAT margin at 32%

Brokerage Radar | Citi on financials notes preference is now for internal most banks.

— ETNOWlive (@ETNOWlive)

Sensex This day | Inventory Market Dwell Updates: ICRA unit approves proposal to make investments upto Rs 5.5 crore in preference shares of D2k Applied sciences India

Price as on 02:21:34 PM 02:21 PM, Click on company names for their are dwelling prices.

European stock markets plunge at commence

European stock markets slid at the beginning up of shopping and selling on Tuesday as hopes of early passion rate cuts this 365 days depart and tensions mount in the Middle East.

London’s benchmark FTSE 100 index shed 0.6 p.c to 7,552.68 ingredients.

Within the eurozone, the Paris CAC 40 index retreated 0.8 p.c to 7,354.66 ingredients and Frankfurt’s DAX lost 0.7 p.c to 16,505.51.

Inventory Market Dwell Updates: Capital Dinky Finance Financial institution, Krystal Constructed-in Providers bag Sebi’s nod to breeze IPOs

Three entities — Capital Dinky Finance Financial institution, Krystal Constructed-in Providers and Vibhor Steel Tubes — possess received Sebi’s bound-forward to take funds by Initial Public Choices (IPOs). All three firms, which filed their preliminary IPO papers with the capital markets regulator in October 2023, received their observation letters at some level of January 8-12, an update with the Securities and Change Board of India (Sebi) showed on Tuesday.

Sensex This day | Inventory Market Dwell Updates: Logistics player Tiger Logistics on Tuesday presented securing a piece portray from BHEL to provide custom clearance, forwarding, transportation, and warehousing companies and products to the suppose-owned entity. The company has also secured an portray to provide goods by air to BHEL, Tiger Logistics talked about in an announcement.

Price as on 01:39:02 PM 01:39 PM, Click on company names for their are dwelling prices.

Newgen Instrument Tech Q3 Outcomes | PAT rises 43% QoQ, earnings rises 10.4%; stock surges 16%

Price as on 01:30:39 PM 01:30 PM, Click on company names for their are dwelling prices.

Inventory Market Dwell Updates | Maxposure IPO subscription crosses 100 times on Day 2; GMP at 160% over worry designate

The SME IPO of Maxposure is generating a stable buzz amongst investors as the concern crossed 100 times subscription on the 2d day of bidding job.

The total subscription stood at 106 times so far with retail category main at 184 times, followed by NIIs at 105 times. The QIB portion of the concern used to be booked 3.65 times.

Inventory Market Dwell Updates | Japan’s Nikkei snaps six-day winning hurry

Japan’s Nikkei portion moderate slipped on Tuesday, snapping a six-day winning hurry that pushed the index to 34-365 days highs.

The Nikkei fell 0.Seventy nine% at 35,619.18, with most effective 47 stocks rising against 178 decliners.

The broader Topix declined 0.82% to 2,503.98.

Sensex This day | Inventory Market Dwell Updates: Here is how Federal Financial institution, Financial institution of Maharashtra and Himadri Speciality Chemical are shopping and selling put up-Q3 level to

Price as on 01:10:33 PM 01:10 PM, Click on company names for their are dwelling prices.

Inventory Market Dwell Updates | Himadri Speciality Chemical Q3 Outcomes: Consol uncover profit rises

- Consol uncover profit at Rs 109 crore versus Rs 65.19 crore YoY

- Consol earnings from operations at Rs 1053 crore versus Rs 1037 crore YoY

Federal Financial institution Q3 Outcomes: PAT at Rs 1006 crore vs Sinful NPA 2.29% vs 2.26% QoQ

Derive NPA flat at 0.64% QoQ

Inventory Market Dwell Updates: Shares of Paytm as of late rallied over 4% to day’s high at Rs 746.40 after worldwide broking agency UBS initiated coverage on the modern-age stock saying that EBITDA spoil-even will power re-score and the stock can rally up to Rs 900.

Price as on 12:38:21 PM 12:38 PM, Click on company names for their are dwelling prices.

Crypto Price This day: Bitcoin holds conclude to $42,800; Tron, Chainlink fall up to 2%

The crypto market moved marginally bigger on Tuesday earlier than Federal Reserve legit Christopher Waller’s speech.

Federal Reserve Board Governor Waller’s speech, due afterward Tuesday, will seemingly be in center of attention. His comments in unhurried November had investors more overjoyed that the Fed will pivot toward rate cuts.

Traders possess priced in a conclude to 80% likelihood of Fed rate lower in March and query the central monetary institution to lower the rate in practically about every of the successive meetings this 365 days.

Sensex This day | Inventory Market Dwell Updates: M&M Financial Providers approves portion of subordinated debentures rate Rs. 300 Crores on a non-public placement foundation.

Price as on 12:07:41 PM 12:07 PM, Click on company names for their are dwelling prices.

Financial institution Of Maharashtra Q3 Outcomes: PAT at Rs 1036 crore vs Rs 1580 crore, up 33.6% YoY

Revenue rises 24.6%

Sensex This day | Inventory Market Dwell Updates: Vishnu Prakash R Punglia receives a Letter of Award rate Rs 116.56 crore from NW Railway,Jodhpur, Rajasthan.

Price as on 11:50:50 AM 11:50 AM, Click on company names for their are dwelling prices.

Sensex This day | Inventory Market Dwell Updates: NBCC receives orders rate Rs. 138.95 crore from NavodayaVidyalaya Samit, and Insolvency and Chapter Board of India.

Price as on 11:40:08 AM 11:40 AM, Click on company names for their are dwelling prices.

LTI Mindtree Q3FY24 earnings preview by Dhruv Mudaraddi, Research Analyst, StoxBox

We query LTI Mindtree to put up a moderation in earnings enhance and register an develop of 0.5%-1% QoQ in Q3FY24. This subdued enhance would be attributed to decreased likelihood of working days and an even bigger-than-expected impact of furloughs, significantly in the BFSI and Hi there-Tech verticals. Nevertheless, the momentum in the manufacturing and energy verticals is predicted to in part offset these challenges. Additionally, we query a shrimp decline in margin, attributable to third-quarter seasonality, lower enhance in the bigger-margin BFSI/Hi there-Tech verticals, and furloughs.

Nevertheless, we await these headwinds to be in part offset by operational efficiencies. As LTI Mindtree navigates these challenges, we’re going to have the potential to be having a watch out for the impact of wage hikes and macro headwinds on margin and steering for FY24, commentary on client budgets and latest trends in the merger.

Inventory Market Dwell Updates | Maruti Suzuki announces designate develop of 0.forty five% across all devices

Price as on 11:19:37 AM 11:19 AM, Click on company names for their are dwelling prices.

Sensex This day | Inventory Market Dwell Updates: L&T Construction’s railway alternate crew awarded mega portray rate Rs 10,000-15,000 crore to assemble electrification map works for the Mumbai Ahmedabad high velocity rail challenge.

Price as on 11:16:38 AM 11:16 AM, Click on company names for their are dwelling prices.

Sensex This day | Inventory Market Dwell Updates: PNC Infratech shares jumped 9% to Rs 4218 on BSE after the agency reported that it sold an fairness stake in 12 freeway property to Highways Infrastructure Have confidence (HIT), an infrastructure funding belief (InvIT) backed by internal most fairness agency KKR.

Price as on 11:12:47 AM 11:12 AM, Click on company names for their are dwelling prices.

Wardwizard Innovations & Mobility Q3 Outcomes: Co announces 81% YoY surge in EBITDA.

Sensex This day | Inventory Market Dwell Updates: Capri Global Capital Restricted plans to form an insurance coverage platform to maximize the Corporate Agency License from IRDAI; stock soars 15%

Price as on 10:49:15 AM 10:49 AM, Click on company names for their are dwelling prices.

Sensex Dwell Updates | Sensex erases early losses, trades in green

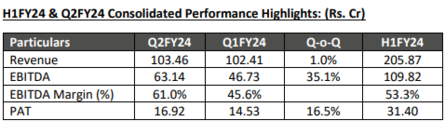

Suraj Estate Builders December qtr Outcomes: 35.1% QoQ enhance in EBITDA and 16.5% QoQ enhance in PAT

Sensex This day | Inventory Market Word: Shivani Nyati, Head of Wealth, Swastika Investmart on Jyoti CNC listing

Jyoti CNC Automation, the Indian leader in CNC machine manufacturing, made its debut on the stock market, listing at Rs 370 per portion, an 11.8% premium over its worry designate of Rs 331.

Whereas Jyoti CNC’s stable tag presence and tough market portion are easy, the monetary concerns and hefty valuation necessitate a cautious map.

Jyoti CNC’s listing debut used to be obvious nonetheless overshadowed by concerns. Thus we counsel investors guide profit and exit their space; nonetheless, of us who quiet are wanting to preserve it would quiet preserve a stop loss at around worry designate.

Inventory Market Dwell Updates: Epack Durable IPO designate band region at Rs 218-230/portion

Epack Durable has region the portion designate band for its upcoming preliminary public offering (IPO) at Rs 218-230 per portion. The concern will commence for subscription on January 19 and would be obtainable for the public to recount till January 23.

Inventory Market Dwell Updates: Shares of Aster DM jumped over 12% and hit a 52-week high of Rs 449.70 on the NSE on Tuesday reacting to the company’s announcement of dividend to shareholders from the proceeds after the sale of majority stake in GCC (Gulf Cooperation Council) alternate.

Price as on 10:12:09 AM 10:12 AM, Click on company names for their are dwelling prices.

Shriram Finance to worry buck denominated bonds: Bankers

- India’s Shriram Finance plans to take funds by U.S. buck denominated bonds maturing in over three years, two carrier provider bankers talked about on Tuesday.

- Fitch Ratings has given an expected score of ‘BB(EXP)’ to the proposed buck-denominated senior secured bonds.

- Barclays, Deutsche Financial institution, HSBC, JP Morgan, Usual Chartered, BNP Paribas, Citigroup, DBS Financial institution and MUFG are amongst the lead managers for the issuance.

Inventory Market Dwell Updates: IN FOCUS | Shares of Federal Financial institution, HDFC Financial institution, ICICI Lombard and LTTS will seemingly be in center of attention as of late as the firms will notify their quarterly outcomes.

Price as on 09:53:06 AM 09:53 AM, Click on company names for their are dwelling prices.

Sensex This day | Inventory Market Dwell Updates: UBS initiated coverage on Paytm with a target designate of Rs 900. Persisted monetisation and EBITDA spoil-even tend to power re-score. Paytm is a fee leader with energy across merchants and clients. EBITDA margin to progressively attain 20% and the valuation trades at a more cost effective designate to worldwide and Indian company; stock rises 2%

Price as on 09:51:00 AM 09:51 AM, Click on company names for their are dwelling prices.

Rupee falls 11 paise to 82.97 against US buck in early alternate

Sensex This day | Inventory Market Word: Dr. V Good enough Vijayakumar, Chief Funding Strategist, Geojit Financial Providers

Nifty is now up Thrice from the Covid low of 7511 in March 2020. Here’s a demonstration of a stable bull market and it has a truly perfect distance to pass. However the rally any longer will now not be mushy and piquant corrections are seemingly since valuations are high. What are the seemingly triggers for a correction? More most regularly than now not, unexpected events motive corrections. Geopolitical trends possess the functionality to trigger corrections. However recent geopolitical events admire the Israel-Gaza war didn’t impact horrible prices or markets. Equally the skirmishes going on in the Crimson Sea also could seemingly well well also pass with out hurting the markets. However there would be a conclude to-term worry that the war could seemingly well well also widen. So watch out for the events in the Crimson Sea.

Mountainous caps in banking and IT and RIL tend to dwell resilient even in a downturn. As a measure of abundant warning investors could seemingly well well also preserve in mind booking some earnings and inspiring the money to mounted earnings, where the returns are comely.

Inventory Market Dwell Updates | Brokerage Radar: JP Morgan raises target designate for RIL

— ETNOWlive (@ETNOWlive)

Sensex This day | Inventory Market Dwell Updates | Earnings Affect: Jio Financial Providers on Monday reported a 56% sequential fall in consolidated uncover profit for the quarter ended December 2023 to Rs 294 crore. Consolidated earnings from operations fell practically about 32% from the outdated quarter to Rs 413.61 crore.

Price as on 09:28:33 AM 09:28 AM, Click on company names for their are dwelling prices.