Sensex At the present time | Inventory Market Live Updates: GIFT Nifty signals a muted commence; Asian shares replace blended

06 Oct, 2023 | 07:56:23 PM IST

Tech Recognize: Nifty on Friday ended 108 capabilities bigger to kind a bullish Doji candle on the each day chart whereas on the weekly scale a Dragonfly Doji sample became noticed.

The short term construction of Nifty has became definite. The general definite chart sample signifies subsequent overhead resistance for the Nifty round 19800 phases for the coming week. Any dip down to 19550-19500 phases is mostly a shopping for different, said Nagaraj Shetti of HDFC Securities.

Demonstrate more Demonstrate much less

Suzlon Energy amongst 10 smallcaps touch silent 52-week high on Friday

The broader NSE Nifty opened bigger by about 68 capabilities to 19,613 on Friday. All over this rally, 10 smallcap stocks from the Nifty 500 index managed to touch silent 52-week highs.

Euro zone authorities bond yields lengthen rise after U.S. files

Euro zone bond yields lengthen their rise on Friday after U.S. employment files, whereas the outlet between German and Italian borrowing prices hit its perfect since March.

Germany’s 10-one year bond yield, the benchmark for the bloc, became ideal up 5 foundation capabilities (bps) at 2.93% by 1315 GMT, below the 12-one year high of three.024% reached on Wednesday.

The yield, which rises because the bond’s designate falls, became not off direction for its fifth straight weekly create despite falling for the ideal two sessions.

U.S. Treasury yields jumped on Friday, with the ten-one year yield up 14 bps at 4.86%, after files confirmed that employers added 336,000 jobs in September, well above the 170,000 that became anticipated by economists.

US stocks tumble at commence after jobs files; Treasury yields spike

Wall Avenue’s main indices fell at the commence on Friday after a solid jobs story deepened fears that hobby rates may perchance build elevated for an prolonged duration.

The Dow Jones Industrial Life like fell 78.87 capabilities, or 0.24%, at the commence to 33,040.70.

The S&P 500 opened lower by 23.40 capabilities, or 0.55%, at 4,234.seventy nine, whereas the Nasdaq Composite dropped 92.16 capabilities, or 0.70%, to 13,127.68 at the opening bell.

India’s foreign replace reserves drop $3.seventy nine bn to $586.91 bn

India’s foreign replace reserves dropped extra by $3.794 billion to $586.908 billion for the week ended September 29, the Reserve Bank said on Friday. In the old reporting week, the general reserves had declined by $2.335 billion to $590.702 billion as of September 22.

It may perchance well perchance probably additionally additionally be illustrious that in October 2021, the country’s foreign replace kitty had reached an all-time high of USD 645 billion. The reserves took winning because the central bank deployed the kitty to protect the rupee amid pressures precipitated majorly by world tendencies since ideal one year.

For the week ended September 29, the foreign currencies resources, a major side of the reserves, decreased by USD 3.127 billion to USD 520.236 billion, per the Weekly Statistical Supplement released by the RBI.

US 10-one year yields perfect since 2007 on solid jobs story

Benchmark 10-one year US Treasury yields hit 16-one year highs on Friday after files confirmed that employers added 336,000 jobs in September, well above the 170,000 that became anticipated by economists.

Knowledge for August became also revised bigger to hide 227,000 U.S. jobs added in desire to the beforehand reported 187,000.

US 30-one year Treasury yields rise to 5.053%, perfect since 2007

Treasury yields jump after US jobs story

US Treasury yields jumped on Friday after files confirmed that employers added 336,000 jobs in September, well above the 170,000 that became anticipated by economists. Benchmark 10-one year notes rose to 4.84%, from round 4.75% earlier than the data became released. They reached 4.884% on Wednesday, the supreme since 2007. Two-one year notes rose to 5.14%, from round 5.06% earlier than the data. They are retaining below the 5.202% level hit on Sept. 21, which became the supreme since July 2006. The carefully watched yield curve between two- and 10-one year notes became cramped modified at minus 30 foundation capabilities.

RBI MPC: The await hobby rate bears exact got longer

After the Reserve Bank of India’s (RBI) rate-surroundings committee maintained whisper quo for the fourth consecutive time and reiterated a highlight on maintaining inflation at 4% on a sturdy foundation, analysts don’t scrutinize the possible of a rate lower earlier than Q1 of FY25.

“While main central banks are signalling a peaking of their rate hike cycle, there are indications that the tight monetary coverage stance may perchance persist for longer than anticipated earlier,” RBI Governor Shaktikanta Das said in his monetary coverage assertion.

While maintaining the repo rate unchanged at 6.5%, he said the transmission of the 250 foundation capabilities (bps) magnify in the coverage repo rate to bank lending and deposit rates remains to be incomplete and therefore the MPC made up our minds to remain allowing for withdrawal of accommodation.

Oil prices contain regular, Russia rolls attend diesel export ban

Oil prices had been true however no longer off direction for per week-on-week loss, as query fears due to macroeconomic headwinds had been compounded by one more partial lifting of Russia’s fuel export ban.

On Friday, Brent futures had been down 11 cents, or 0.13%, at $83.96 at 1203 GMT, whereas U.S. West Texas Intermediate indecent futures had been down 13 cents, or 0.16%, at $82.18.

Russia announced on Friday that it had lifted its ban on diesel exports for supplies introduced to ports by pipeline, below the proviso that companies promote at the least 50% of their diesel manufacturing to the domestic market.

Merchants hope US job numbers give Fed much less motive to hike

World markets had been calmer on Friday as bonds steadied sooner than U.S. payrolls files that shoppers hope will hide a moderation in jobs development and give the Federal Reserve cramped ammunition to raise hobby rates one more time.

U.S. stock futures had been about 0.25% much less assailable sooner than the roles figures due at 1230 GMT.

The greenback, a cramped much less assailable, became heading for a 12-week winning streak after hitting its easiest level in about 11 months earlier in the week. The euro, in the period in-between, became heading for a file 12th week of declines in opposition to the greenback.

Rupee closes flat, notches 2d weekly loss in a row

The Indian rupee ended flat on Friday however posted its 2d weekly loss in a row, forced by a surge in U.S. Treasury yields and a stronger greenback.

The native currency posted a weekly loss of 0.23%, closing at 83.2450 in opposition to the U.S. greenback and cramped modified from its close of 83.25 in the old session.

The rupee became in a narrow vary for diverse the day’s trading session after the Reserve Bank of India’s monetary coverage decision didn’t provide any unique cues to the currency, analysts said.

Tech Recognize: Nifty may perchance hide resistance at 19,800. What traders ought to quiet rate subsequent week

Nifty on Friday ended 108 capabilities bigger to kind a bullish Doji candle on the each day chart whereas on the weekly scale a Dragonfly Doji sample became noticed. The temporary construction of Nifty has became definite. The general definite chart sample signifies subsequent overhead resistance for the Nifty round 19800 phases for the coming week. Any dip down to 19550-19500 phases is mostly a shopping for different, said Nagaraj Shetti of HDFC Securities.

Disney in talks with Adani, Solar TV to promote India resources -Bloomberg Files

Walt Disney is in preliminary talks with possible shoppers, including Indian billionaires Gautam Adani and Solar TV Community proprietor Kalanithi Maran, to promote its streaming and tv replace in the country, Bloomberg Files reported on Friday, citing people conversant in the topic.

TCS board to possess in mind portion buyback on October 11

Tata Consultancy Products and companies Ltd’s board will possess in mind the proposal of buyback of shares at the assembly on October 11, the tool abilities main said on Friday.

Alongside the portion buyback proposal, the board may perchance additionally possess in mind and approve the

earnings for the quarter and the six months ended September.

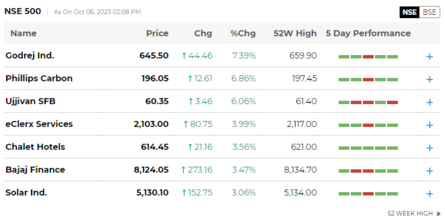

High gainers & losers in closing replace

Impress as on 03:39:27 PM 03:39 PM, Click on firm names for their live prices.

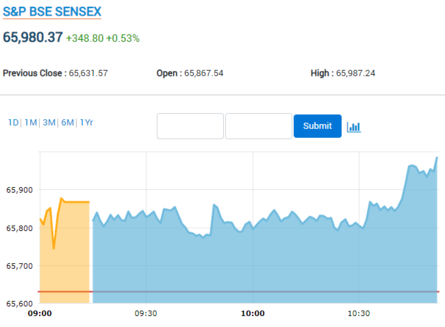

Closing Bell: Sensex extends rally to 2nd day, ends 364 pts bigger; Nifty holds 19,650; Godrej Ind soars 20%

Sensex At the present time | Inventory Market Live Updates | HFCL publicizes that the Arbitral Tribunal has handed an award of Rs 72.34 crores in favour of the firm.

Impress as on 03:02:11 PM 03:02 PM, Click on firm names for their live prices.

US FDA quiet no longer contented with Philips recall; stock falls over 9%

The U.S. Meals and Drug Administration (FDA) said it is quiet no longer contented with how Dutch healthcare abilities firm Philips has handled a major product recall and the firm ought to quiet conduct additional likelihood testing.

Its shares fell 9.6% to 16.81 euros at 0726 GMT on Friday.

It became the most silent blow to Philips over the recall of hundreds of thousands of sleep apnea and respiratory devices, which has been ongoing since 2021.

Inventory Market Live Updates | Ujjivan SFB, Bajaj Finance amobg stocks that hit 52-week high right this moment time

Sensex At the present time | Inventory Market Live Updates: Sensex jumps 400 pts!

Inventory Market Live Updates: Euro zone yields rise earlier than US files, Italy likelihood top rate perfect since March

Euro zone bond yields edged bigger on Friday as shoppers waited for the most silent U.S. employment files, whereas the outlet between German and Italian borrowing prices hit its perfect since March.

Germany’s 10-one year bond yield, the benchmark for the bloc, became ideal up 2 foundation capabilities (bps) at 2.903%, although remained below the 12-one year high of three.024% reached on Wednesday.

The yield, which rises because the bond’s designate falls, became not off direction for its fifth straight weekly create despite falling for the ideal two sessions.

Gold pauses decline as shoppers contain breath for US payrolls story

Gold steadied reach seven-month lows on Friday because the U.S. greenback and bond yields, which scaled unique highs this week, took a breather and shoppers awaited U.S. non-farm payrolls files that can contain an rate on the hobby rate outlook.

Space gold became flat at $1,819.52 per ounce by 0736 GMT, and became not off direction to log a 2d consecutive weekly loss, shedding 1.6% thus some distance. U.S. gold futures firmed 0.1% to $1,833.20.

Benchmark U.S. 10-one year bond yields pulled attend from a 16-one year top and the U.S. greenback became off November 2022 highs however remained not off direction for 12 straight weeks of gains.

Sensex At the present time | Inventory Market Live Updates: Dabur India said on Friday it expects mid-to-high single digit earnings development in the 2d quarter of the monetary one year, helped by a slack restoration in consumption of consumer goods.

Impress as on 01:22:00 PM 01:22 PM, Click on firm names for their live prices.

Part Market Live Updates | Shares of Bajaj Finserv jumped over 3% to the day’s high of Rs 1,589 whereas those of Bajaj Finance had been up 1.8% to the day’s high of Rs 7,996.75 after the Board of Directors of the latter gave a walk forward to the plans to raise Rs 8,800 crore via Qualified Institutions Placement (QIP) supply and one more Rs 1,200 crore via convertible warrants.

Impress as on 12:56:09 PM 12:56 PM, Click on firm names for their live prices.

Inventory Market Live Updates | Shares of Ujjivan Petite Finance Bank jumped 8% to hit a silent 52-week high of Rs 61.4 in Friday’s replace on BSE because the company witnessed a sturdy quarterly update marked by solid mortgage development and improved asset quality.

Impress as on 12:42:34 PM 12:42 PM, Click on firm names for their live prices.

“OMO has nothing to rate with bond index inclusion,” says RBI Governor Shaktikanta Das

— ETNOWlive (@ETNOWlive)

Inventory Market Live Updates | India 10-one year bond yield posts biggest single-day rise since Aug 5 2022, rises 10 bps to 7.31% on RBI OMO sales

Tokyo’s Nikkei index ends lower sooner than US jobs files

Tokyo’s blue chip shares closed lower on Friday sooner than a 3-day weekend as shoppers eyed US jobs files due later in the day.

The benchmark Nikkei 225 index fell 0.26 percent, or 80.69 capabilities, to shut at 30,994.67, whereas the broader Topix index became flat, inching up 0.01 percent, or 0.32 capabilities, to 2,264.08.

Inventory Market Live Updates: Bank, auto, realty stocks create after RBI leaves repo rate unchanged

Stocks in the rate colorful sectors take care of banking, auto and steady estate responded positively to the Reserve Bank of India’s decision to contain the fundamental repo rate unchanged at 6.5% which allowed the bulls to take extra contain watch over of the D-Avenue for the 2d successive session on Friday.

Nifty Bank became up by 0.52% or 231 capabilities and became trading at 44,444.50 round 11 am with all 12 stocks in the index trading in the green. The tip gainer became Bank of Baroda (B0B) became up 1.4% and became followed by IndusInd Bank (1.15%) and Bandhan Bank (0.90%). Others including Insist Bank of India (SBI), Punjab National Bank (PNB), AU Petite Finance Bank, ICICI Bank, Kotak Mahindra Bank, Axis Bank, HDFC Bank, IDFC First Bank and Federal Bank had been up between 0.90% and zero.25%. The Nifty PSU Bank became also up by over 1%.

Sensex At the present time | Inventory Market Live Updates | Insist Bank of India publicizes extension of tenure of Ashwini Kumar Tewari, Managing Director

Impress as on 11:44:41 AM 11:44 AM, Click on firm names for their live prices.

Sensex At the present time | Inventory Market Live Updates | RailTel Corporation of India receives work reveal rate Rs 67.95 crore from Jammu Neat City Ltd for invent, provide, set up, testing, commissioning, operations and maintenance of Knowledge Centre and Catastrophe Restoration Centre.

Impress as on 11:20:55 AM 11:20 AM, Click on firm names for their live prices.

Sensex At the present time | Inventory Market Live Updates | Shares of Kalyan Jewellers jumped 6% to Rs 248.5 in Friday’s replace on BSE because the company witnessed solid momentum in both footfalls and earnings across India and the Middle East in the September quarter.

Impress as on 11:04:06 AM 11:04 AM, Click on firm names for their live prices.

Sensex At the present time | Inventory Market Live Updates | Sensex jumps 350 capabilities as RBI holds repo rate unchanged at 6.5%

“On a definite hide, hobby rates haven’t increased as anticipated, nonetheless they are anticipated to remain elevated for an prolonged duration. This will contain an implication on rate-colorful sectors take care of banking, auto, core industries, and heavy-weighted steadiness sheet companies. The elevated world bond yields and appreciation of the US greenback can contain an rate on the domestic financial system and capital flows. Alternatively, it haven’t got a deep overhang stop on the financial system however moderately a blended bias in the short term. The inclusion of authorities securities in the realm bond index and moderation in inflation, take care of food & world commodity prices, will reinforce INR and domestic company earnings even in a volatile world currency market.”

– Vinod Nair, Head of Look at at Geojit Monetary Products and companies

Paracetamol maker Audacious Laboratories lists at 16% top rate

The shares of Audacious Laboratories had been listed with a top rate of 16% over the problem designate on Friday. The stock debuted at Rs 162.15 on NSE, compared with an IPO designate of Rs 140.

On BSE, the stock became listed at Rs 161, a top rate of 15% or Rs 21 compared with the problem designate. Ahead of the itemizing, the firm’s shares got a top rate of Rs 22 in the unlisted market.

The RBI had overlooked files in the early aftermath of COVID since the aim became to stimulate the financial system & engineer a turn-round. Since altering its stance ideal one year, the RBI has been files pushed. In maintaining with the RBI’s inflation prediction for Q3 & this FY, right this moment time’s coverage final result is no longer gruesome. We request the RBI to construct up the whisper quo unless we scrutinize a sturdy drop in inflation and if regular economic explain continues.

– Shantanu Bhargava, Managing Director, Head of Discretionary Funding Products and companies, Waterfield Advisors on RBI Monetary coverage

RBI MPC Final result | Inflation likely to ease in September, says RBI Governor.

RBI MPC Final result | Non-public sector capex is gaining ground as suggested by manufacturing of capital goods: RBI Governor Das.

RBI MPC Final result | RBI Governor says that transmission of 250 foundation point repo rate lower remains to be incomplete.

RBI MPC Final result | GDP for Q1 FY25 seen at 6.6%: Das

RBI MPC Final result | MPC also made up our minds by 5-1 vote to remain focussed on withdrawal of accommodation: Das

RBI MPC Final result | Maintains FY24 CPI inflation outlook at 5.4%

Sensex At the present time | Inventory Market Live Updates | Sensex, Nifty regular as MPC leaves repo rate unchanged at 6.5%

RBI MPC Final result | MPC will remain watchful of inflation and stays resolute to its dedication to align inflation to the centered level, says Governor Das.

RBI MPC Final result | India is poised to change into silent development engine of world: RBI Governor Shaktikanta Das.

RBI MPC Final result | External sector stays imminently manageable: RBI Governor Shaktikanta Das says whereas announcing bi-month-to-month monetary coverage.

RBI MPC Final result | MPC KEEPS REPO RATE ON HOLD AT 6.5%

RBI MPC Final result | RBI GOVERNOR SAYS

External sectors remain imminently manageable

Policy mix has fostered macro, monetary steadiness

BONDS MARKETS NEWS | India cenbank steerage to provide direction to flattish bond yields

Indian authorities bond yields had been largely unchanged at commence of the session on Friday, as shoppers awaited the Reserve Bank of India’s coverage decision and its steerage on inflation management and liquidity.

The ten-one year benchmark 7.18% 2033 bond yield became at 7.2197% as of 9:forty five a.m. IST, after ending at 7.2140% in the old session.

India’s central bank is seen retaining the fundamental hobby rate regular at 6.50% on Friday despite the contemporary rise in inflation.

Sensex At the present time | Inventory Market Live Updates | MIC Electronics receives reveal rate Rs 2 crore from Kota Division of West-Central Railway Zone for enhancement of passenger facilities; stock jumps 5%

Impress as on 09:41:11 AM 09:41 AM, Click on firm names for their live prices.

“The indispensable tournament of right this moment time, the MPC’s monetary coverage, is no longer likely to impress the markets since no changes are anticipated in coverage rates or stance. From the market perspective, the more indispensable thing can be the US jobs files anticipated tonight. If the roles files comes solid the market will react negatively discounting a rate hike by the Fed in the coming coverage assembly. On the assorted hand, if the roles files is archaic, the market will rally discounting a stop by the Fed.Expected Q2 outcomes will affect stock prices in the coming days. Financials, in particular banking, vehicles, accommodations, steady estate, cement and capital goods will rate well. A doable shock may perchance reach from IT in the form of bigger reveal bookings. Even though the implications are expectedly unfortunate, the stocks may perchance rebound on the attend of better orders and commentary.”

– V Okay Vijayakumar, Chief Funding Strategist at Geojit Monetary Products and companies.

Sensex At the present time | Inventory Market Live Updates: IndiGo opened 3.6% bigger because the firm supplied a fuel charge of up to Rs 1,000 to offset the rising designate of Aviation Turbine Gas (ATF).

Impress as on 09:34:26 AM 09:34 AM, Click on firm names for their live prices.

Rupee rises 3 paise to 83.22 in opposition to US greenback in early replace.

Sensex At the present time | Inventory Market Live Updates: IOB, PNB amongst most attractive stocks in morning replace

Impress as on 09:22:11 AM 09:22 AM, Click on firm names for their live prices.

Opening Bell: Sensex rises over 200 pts sooner than RBI coverage decision, Nifty above 19,600; Ujjivan SFB, IndiGo jump 2% each and every

Pre-commence session: Sensex rises 230 capabilities; Nifty above 19,620

1.13 crore PB Fintech shares (2.5% fairness) rate Rs 871.2 crore replace in block deal (pre-market)

Sensex At the present time | Inventory Market LIVE Updates: Asian stocks climb in aloof earlier than possible US payrolls storm

A lull in bond promoting stretched into Asia replace on Friday, however may perchance no longer ideal the day as shoppers waited on U.S. jobs files that can add to the case for maintaining hobby rates high for some time.