International investors come by modest purchases on Dalal Road in Feb

Mumbai: International investors provided Indian equities value ₹5,107 crore in February, after pulling over ₹25,000 crore out of the home stock market within the earlier month. Analysts acknowledged though the figures are exhibiting net purchases by these investors, their sentiment in direction of India is caution after the sizzling mosey-up in stock prices.

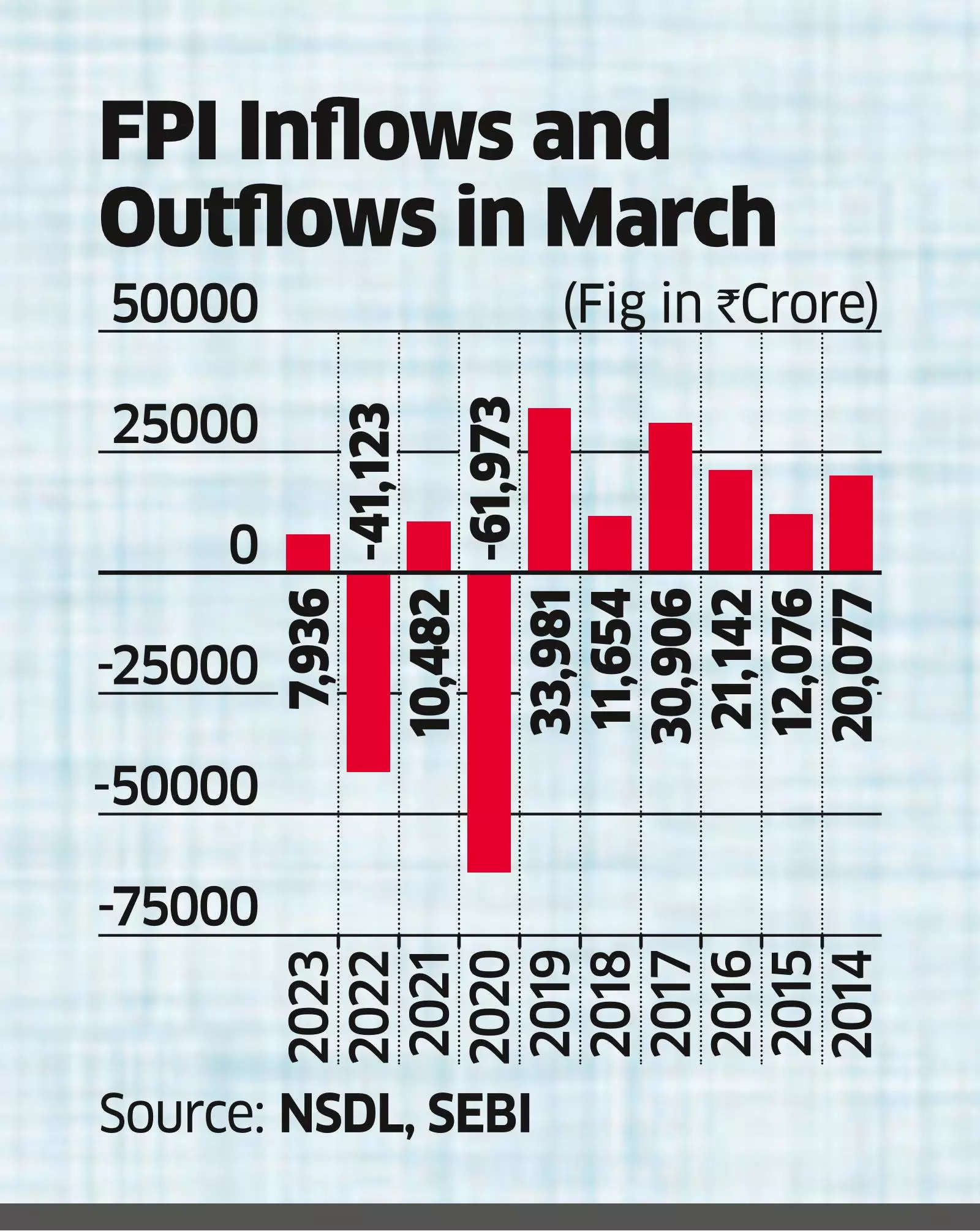

A exact revival in international institutional hunting for in March also seems no longer actually, acknowledged analysts though seasonal trends speak that out of the country investors delight in largely bought at some level of the month.

Within the previous 10 years, international investors were traders of home shares in March on eight cases and sellers on two.

Businesses

Businesses“The tempo of international inflows are inclined to stay common in March,” acknowledged Sriram Velayudhan, senior vp, IIFL Securities. “Cues from US inflation will delight in a pertaining to the approaching rate cut cycle and this skill that fact emerging market flows.”

On Thursday, the Sensex and Nifty obtained 0.3% and zero.1%, respectively, sooner than the commence of a US inflation studying in a single day that is seen taking half in a key role in figuring out the Federal Reserve’s ardour rate cut timing.

In February, the Sensex and the Nifty rose about 1.3% each as the market swung between gains and losses for quite a lot of the month.

“Inflows in February were miniscule in nature since most international investors handiest engaged in trading,” acknowledged Abhilash Pagaria, head of replacement & quantitative analysis at Nuvama.

“While the FTSE index rebalancing might perhaps lead to just a few inflows, international investors are no longer at risk of approach encourage to Indian equities with a bang.”

Analysts acknowledged India’s contemporary outperformance, which has resulted in portion valuations getting pricier, is pushing international fund managers to support in mind more affordable markets within the set up.

“International investors are shying far from Indian equities due to high valuations and deploying funds in assorted emerging market economies love Korea and Thailand,” acknowledged Pagaria.“Except there might perhaps be some deep correction within the markets, exact inflows stay no longer actually.”

Pagaria acknowledged that currently there are no exact signs indicating a international inflow for March.

International inflows were repeatedly exact in pharma, FMCG, auto and capital items over the previous couple of months, on the opposite hand the financial sector—the most influential on the benchmark indices– has witnessed promoting over 30,000 crore in January. Analysts acknowledged the inflows in February were minor and though the international investors did offload shares, the tempo of promoting was as soon as lowered.

“International investors delight in engaged in fundamental promoting within the financial dwelling (per NSDL fortnight info) in February as that sector is below rigidity,” acknowledged Velayudhan. “The tempo of total international promoting has on the opposite hand moderated in February when in contrast to January.” Velayudhan acknowledged that publish elections, the second half of the one year might perhaps presumably behold stronger international inflows.