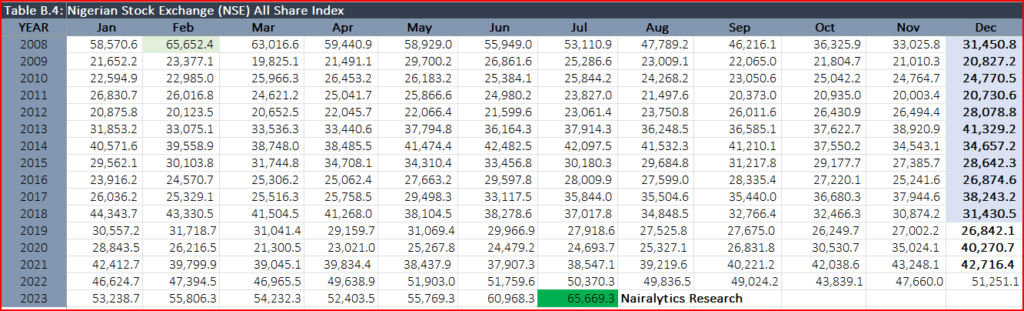

BREAKING: Nigerian Equities All Part Index hit ALL TIME HIGH of 65,669.29 choices

The Nigerian Alternate All Part Index closed purchasing and selling on Tuesday, July 11th at 65,669.29, crossing the tip of month all-time high stop of month level recorded in February 2008.

The old stop of month high for the stock market changed into once 15 years ago or February 2008 when it closed at 65,652.4, an era that is in general identified as the peak of the stock market boost of the early 2000s.

On the other hand, the narrative single day all time high for Nigerian shares stays 66,671 achieved fifth March 2008.

2008 vs 2023

Why this matters: The stock market on the time changed into once boosted by several non-public placements that went on to turn out to be preliminary public offerings, well suited components, and public provides as investors raised money from a wealth-driven retail investor market.

- The market on the time changed into once furthermore buoyed by hundreds of billions of naira in margin lending which enthusiastic borrowing money from industrial banks to invest within the stock market using the equities as collateral.

- Inflows salvage been a huge N4.6 trillion in 2008, the highest to this level. International and home participation changed into once N3.9 trillion and N787 billion respectively.

- The market unraveled and at closing crashed, falling to as low as 19,825.1 by March 2009, the lowest level ever recorded since 2008.

What is diversified: This time spherical, there are no margin lendings or public offerings, or retail investor frenzy.

- What now we salvage seen is a bull roam that is driven by policy choices considered as obvious for a stock market that has traded at low costs earning multiples for nearly a decade.

- The bull roam is being driven by investors, mega-billionaire moves, and international investors who’re step by step returning to the stock market.

- A rather a hit election, revision of the forex insurance policies to a managed drift, and the removal of gasoline subsidies salvage furthermore boosted funding sentiments.

- We salvage got furthermore seen an amplify in capital inflows within the stock market with about N1 trillion recorded within the first 5 months of this 365 days in contrast to N1.5 trillion within the whole of 2022.

Despite the vast bull roam being witnessed, capital inflows within the stock market are no longer anticipated to be on the same ranges recorded in 2008 when the June file is launched.

Nigerian Equities at demonstrate alternate at a tag-to-earnings multiple of 11.77x, greater than its rising market friends of South Africa, Egypt, Kenya, and Ghana which alternate at 10.57, 8.79x, 5.69x, and 3.19x respectively.

Day-to-day Performance Myth

The Nigerian equity market maintained its bullish pattern as market capitalization increased by N580 billion on the shut of purchasing and selling on the present time, 11th July 2023.

- The market changed into once boosted greater by 1.65%, from N34.177 trillion within the day long previous by’s session to N35.757 trillion.

- The market has maintained a obvious momentum for the previous week, starting from Tuesday, 4th July 2023. This signifies solid self perception among investors and traders within the contemporary financial outlook.

- The All-Part Index (ASI) rose by 1,065.6 choices to shut at 65,669.29 choices on Tuesday, 11th June 2023 from the old shut of 64,603.69 choices on Monday.

The market witnessed a sharp decline within the tag of transactions, as the total tag of traded shares fell to N9.41 billion, a 57.3% decrease from the old session’s N22.03 billion.

Market Indices

Below are the market indices for on the present time’s purchasing and selling session:

NGX ASI: 65,669.29 choices

% Day Alternate: 1.65%

% YTD: +28.13%

Market Cap: N35.757 trillion

Quantity Traded: 844.72 million

Price: N9.41 billion

Offers: 8,922

How Stocks Performed

This day, the stock market skilled a most well-known shift, with CHELLARAM main the gainers with a 10.00% amplify in its tag.

- CHIPLC suffered the biggest loss with a 10% tumble in its piece tag, and CHAMS recorded the highest quantity of alternate on the tip of the market session.

- The purchasing and selling quantity changed into once lower on the present time, with 8,922 deals closed, down from 14,584 deals within the old session, showing a decline in exercise accessible on the market.

Top Gainers and Top Losers

CHELLARAM, OMATEK, and SOVRENINS, all with a piece tag compose of 10%, dominated on the present time’s stock market.

- These impressive gains surpassed those of diversified companies and lifted the overall market mood.

- Others then again contributed to the market’s decline with CHIPLC, CHAMPION, and MCNICHOLS losing 10%, 9.89%, and 9.33% respectively.

Top Traded Stocks

The purchasing and selling quantity on the present time dropped to 844.72 million shares from 1.84 billion shares. This represents a 54% decline in contrast to the day long previous by.

- The top three equities accessible on the market on the present time via purchasing and selling quantity salvage been CHAMS, FCMB, and UNIVINSURE, with 91.71 million, 78.68 million, and 75.01 million devices traded, respectively.

- UBA led on the present time’s stock market purchasing and selling with a tag of N795.32 million, FCMB got right here in second with a tag of N551.89 million, while TRANSCORP got right here in third with a tag of N245.14 million.

SWOOTs Seek

The cement sector performed successfully, with DANGOTE CEMENT and BUA CEMENT rising by 9.27% and 6.59% respectively.

- On the other hand, the banking and telecom sectors declined, with UBA, ZENITH BANK, MTN NIGERIA, and GTCO shedding 4.03%, 2.01%, 0.71%, and 0.28% respectively.

- AIRTEL AFRICA and BUA FOODS remained unchanged on the present time, with the same closing values as the day long previous by. These companies showed a staunch market performance, reflecting a balanced seek knowledge from and provide.

FUGAZ Update

The stock market closed with harmful returns for the main banks on the present time.

- The largest losers salvage been ACCESS HOLDINGS, UBA, FBNH, ZENITH BANK and GTCO, which declined by 4.5%, 4.03%, 3.59%, 2.01% and 0.28% respectively.

Update: This text changed into once updated to define that the all-time high is quiet 66,371.2 recorded March 15, 2008.