What a solid ‘Santa Claus rally’ says about the U.S. stock market in January — and 2024

This holiday season has to this level been comparatively constant in giving merchants precisely the gift they need — a “Santa Claus rally” that will per chance raise epic highs for U.S. stocks, with Wall Avenue on meander to shut out 2023 with solid beneficial properties.

Inspect: ‘Santa Claus rally’ time for stock market? Why merchants ought to accrued dial support their expectations for this seasonal 300 and sixty five days-cessation gift.

The term refers to a phenomenon where the stock market closes greater for the final 5 trading days of primarily the most up to date 300 and sixty five days and the principle three trading days of the unique 300 and sixty five days. This 300 and sixty five days’s Santa Claus rally duration officially kicked off Friday, and has viewed the S&P 500

SPX

rise 0.6% over the final two trading days, whereas the Nasdaq Composite

COMP

has climbed 0.7% and the Dow Jones Industrial Realistic

DJIA

remained almost flat over the identical duration, in step with FactSet data.

Nonetheless, data gift that a solid Santa duration in most cases leads to a no longer easy January, in step with Andrew Greenebaum, senior vice president of equity analysis product administration at Jefferies.

“In the identical manner that filling up at a noteworthy-anticipated holiday meal can in most cases leave you feeling uneasy and a chunk overindulgent, too noteworthy of a December rally looks admire it can per chance pull from January returns,” he acknowledged in a Saturday consumer show.

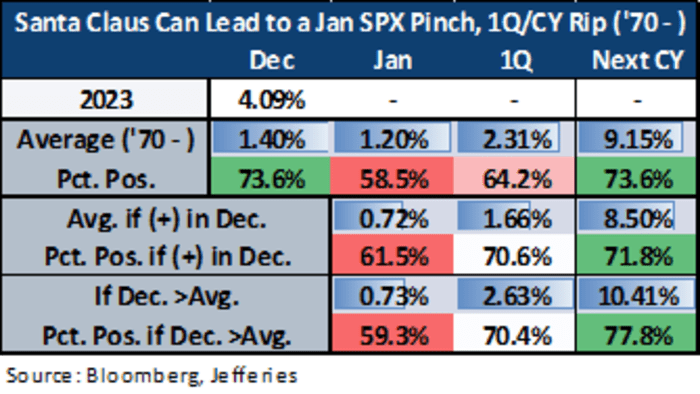

Courting support to 1970, the frequent efficiency of the S&P 500 in December has introduced beneficial properties of 1.4%. While January is rarely any longer precisely “shabby,” with a monthly moderate designate of 1.2%, the strategy will get almost halved when December is inconspicuous or even above moderate, in step with data compiled by Jefferies (seek for table beneath).

Offer: Bloomberg, Jefferies

“January — name it a pull forward — tends to seem for worse-than-identical earlier returns, and in fashioned, the month has a greater likelihood of detrimental S&P 500 trace motion,” Greenebaum acknowledged.

Nonetheless, there are accrued some positives to take into epic, the analyst added. No topic the more-customarily detrimental January that comes after a solid December, the S&P 500’s returns for the following calendar 300 and sixty five days are seemingly to be round 1% greater than moderate when the prior December records a greater-than-moderate strategy, Greenebaum acknowledged. The calendar 300 and sixty five days additionally ends up with obvious returns almost 80% of the time, he added.

Inspect: S&P 500 is transferring toward epic territory. Here’s what stock-market merchants ought to know.

U.S. stocks carried out greater on Tuesday to kick off the final trading week of the 300 and sixty five days. The S&P 500 was up 0.4%, to total at 4,774, whereas the Dow Jones Industrial Realistic edged up 0.4%, at 37,545, and the Nasdaq Composite jumped 0.5%, to total at 15,074, in step with FactSet data.