Mild Mexico bill to lower profits taxes and cap investment tax smash advances

A bill that would possibly within the reduction of non-public profits taxes throughout the earnings spectrum and bag extra taxes on investment profits passed the Democratic-led Mild Mexico affirm Home on Wednesday.

The tall kit of tax adjustments obtained Home endorsement on a forty eight-21 vote and now strikes to the Senate for consideration.

Sigh executive would forgo about $105 million per annum overall through adjustments to non-public profits tax rates and brackets while gathering extra taxes on investment profits.

WITH PRESIDENTIAL RACE ON HORIZON, NEW MEXICO LAWMAKERS LOOK TO OUTLAW FAKE ELECTORS

All profits tax payers would know a few lower, with the ultimate financial savings in greenback phrases among center-profits earners, in accordance with an prognosis by the affirm Taxation and Income Department.

Annual profits tax would lower by $16, or 12%, to $136 for a couple with taxable profits of $8,000, the agency talked about. A wealthier couple with an annual taxable profits of $400,000 would set about $553, or 2.8%, on annual taxes of $20,042.

The bill from Democratic affirm Gain. Derrick Lente, of Sandia Pueblo, additionally involves tax credits and deductions aimed at shoring up the medical team in distant rural areas and easing the fiscal burden on minute one care and preschool suppliers.

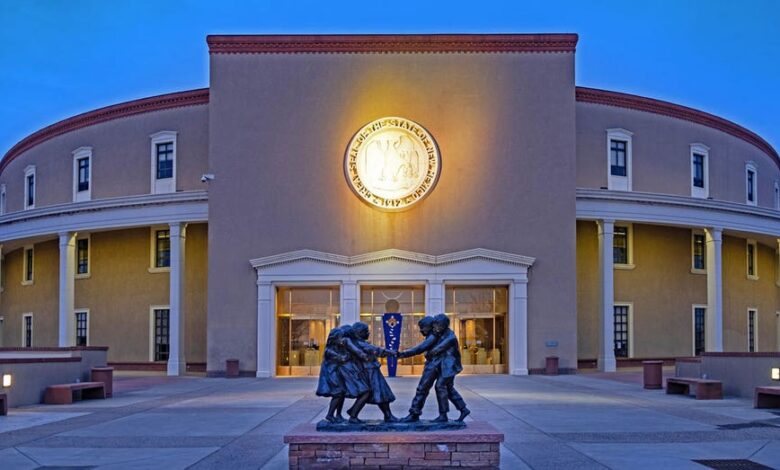

The Mild Mexico Capitol is viewed right here after sundown. A bill to sever non-public profits tax passed the Mild Mexico Home. (Marica van der Meer/Arterra/Universal Photography Community via Getty Photography)

He talked about in a statement that the bill aims to “toughen access to healthcare and childcare, toughen natty vitality, and provide toughen for our pals and neighbors who need it most.”

The bill would incentivize the building of sizable-scale vitality storage projects — which will invent renewable wind and solar vitality production extra recommended — by reducing local executive taxes on the facilities throughout the convey of business earnings bonds.

Proposed adjustments for agencies would attach a flat 5.9% payment for the corporate profits tax at corporations with lower than $500,00 in annual profits.

Mild Mexico residents who seen their properties destroyed in contemporary wildfires would be eligible for novel profits tax credit rating.

CLICK HERE TO GET THE FOX NEWS APP

A statement from Home Democrats says the bill reduces a cap on capital beneficial properties tax exemptions to $2,500 — limiting a tax smash “that overwhelmingly advantages the affirm’s very most life like earners.”

Home Republicans led by affirm Gain. Jim Townsend, of Artesia, unsuccessfully proposed extra aggressive tax cuts in light of an estimated $3.5 billion customary fund surplus for the arriving fiscal year. In a failed modification, he urged a flat 1% tax on non-public profits.

Most modern rates fluctuate from 1.7% on taxable profits beneath $4,000 for of us to 5.9% on annual profits over $157,000.